Believe it or not, this is the most posed question when somebody searches Google for a home loan. I wish I could tell you the answer is as simple as ABSA, FNB, Nedbank or Standard Bank, but unfortunately, it is not!

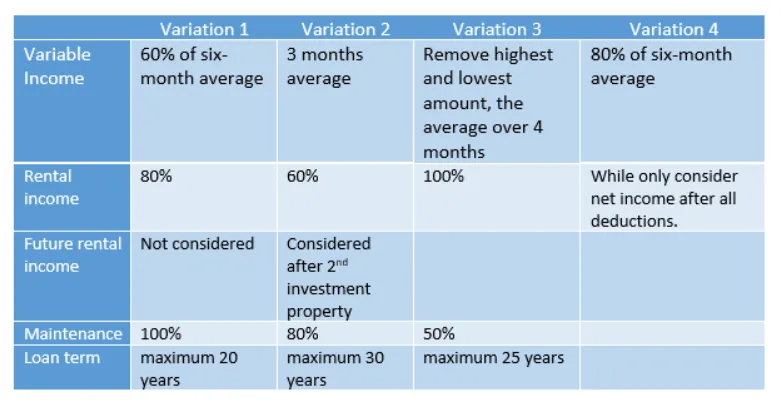

Even though a home loan is a very straightforward product to finance the purchase of a residential property, the banks’ credit criteria for a home loan differ quite substantially. The best way to demonstrate this is with a table…

The above table clearly demonstrates that if you earn a commission, receive overtime, rental income or maintenance, depending on which bank you approach, you can either afford to purchase your dream home or not.

Furthermore, a 30 year home loan will help you qualify for a higher home loan amount or a reduced monthly instalment on the same loan amount as a 20 year home loan. This is a crucial fact when you consider that your monthly instalment must not be much more than 30% of your income. Some banks will tell you that they only use the 30% as a guideline, but we beg to differ, in our experience, they apply this percentage quite stringently.

We won’t even begin to discuss the various considerations for self-employed individuals, because that is a whole opinion piece on its own. Let’s just put it out there, if you are self-employed, best you avoid all the difficulties and frustrations and apply for a home loan through us. Trust me, it will save you a lot of grey hair.

But even if your home loan application is not affected by any of the above variations, you have to contend with the banks’ current appetite for risk, how each of them “score” your application, what they paid for money on that day, their exposure to an area or complex in which you are buying and we regularly experience new deviations. All these factors will affect the interest rate they will offer you and whether a deposit will be required.

However, to me the most crucial variation is the flexi/access facility. It is a non-negotiable must-have! The only time that I will recommend you let this one go is when it compromises your ability to get the required home loan and purchase a property. Otherwise, always ensure that it forms part of the terms and conditions of your final quotation. Watch out, not all banks offer this on all their home loan products.

To be clear, if you wish to be guaranteed receiving the ultimate home loan, best you allow us to apply on your behalf. We will look at what each bank offers you, based on your personal circumstances and individual requirements and relentlessly fight for the best deal on your behalf.

To answer the question – which bank offers the best home loan? We will reciprocate with – what is your current financial position and what matters most to you? And therein lies your answer.