A non-resident homebuyer purchases a property in Cape Town. He has a substantial deposit, a bit more than the required 50% for non-resident homebuyers, and needs a small home loan for the balance.

Several banks approve this home loan, but, in our professional opinion, the bank that would offer the client the best home loan option in terms of conditions of the home loan, costs and interest rate, did not find sufficient value in the property. For us, accepting second best is a bitter pill to swallow.

We motivated that the other banks found value, but the institution in question, would not accept our supported argument and stuck to their guns.

The estate agent advised that they had sold another unit in the same complex, albeit 45% bigger, for a substantially higher sale price. The transfer of this unit had not registered yet. The registration of this sale was important, as it would affect the property valuation software, used by both state agents and banks alike, positively.

“How the West was won!”

We obtained a written statement from the transfer attorney handling the sale of the bigger unit, confirming that all suspensive conditions had been met, guarantees for the full purchase price had been obtained and the transfer was imminent.

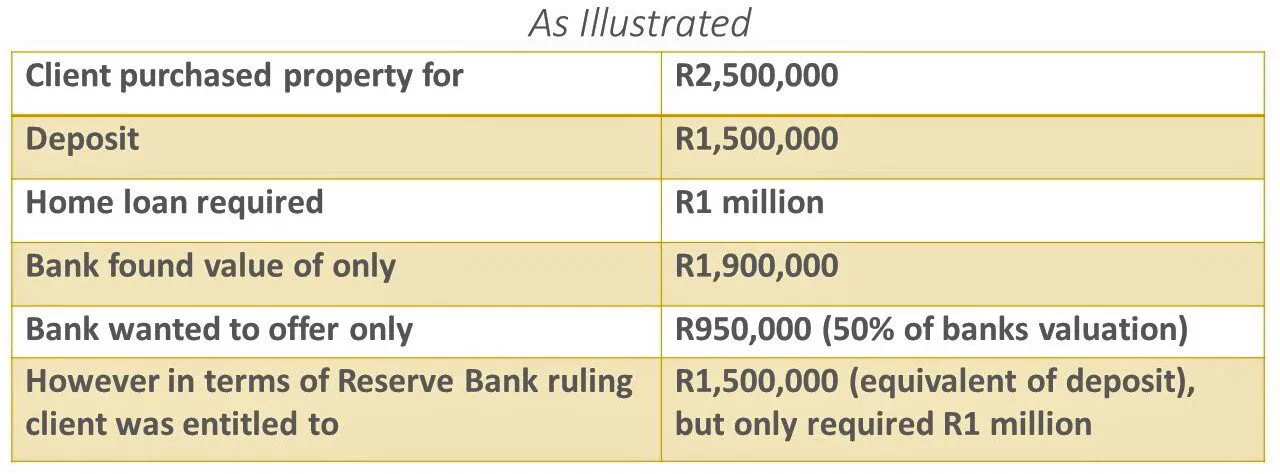

In terms of the Reserve Bank ruling, a non-resident may borrow an equivalent of what they introduced into the country for the purpose of purchasing a residential property. The banks interpret this as 50% of the purchase price or their valuation, whichever is the lowest. While they are entitled to use whatever credit criteria they chose, stating that the 50% LTV requirement is in terms of the Reserve Bank ruling, is not strictly true. My client had introduced more than 50% of the purchase price and therefore was entitled to an equivalent.

Using the other offers obtained from the banks, confirmation from the transferring attorney and clarity on the Reserve Bank ruling, we obtained an offer of R50 000 more than our client initially needed, at the very best terms and conditions the market had to offer.

Had do you been placed in a similar situation, would you be able to achieve this, without inside knowledge acquired through years of experience? That is the value of using the FREE service of a good bond originator.

(Names have been omitted to protect the identity of the client and the bank and integrity of the transaction)